Spektrix Data Insights

The latest analysis of arts audience behaviours - from ticket buying to philanthropy, online activity, and reattendance.

Tomorrow’s Audience was developed in 2023 as an Indigo Share: Hot Topic, in association with a consortium of the UK’s leading arts organisations and in partnership with Spektrix.

The project was designed to help performing arts organisations across the UK to:

In-depth insights on the audiences of the future, presented by Spektrix and Indigo Ltd

2023 saw record numbers of people booking tickets for cultural events, and the last two years have seen a higher proportion of first-time bookers than ever before.

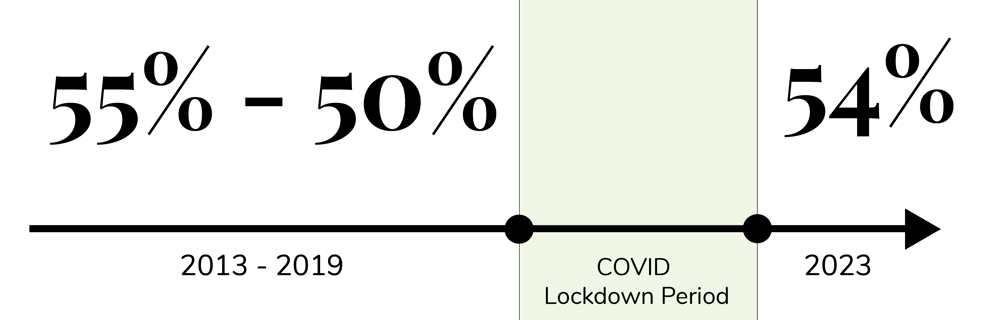

By 2019, before Covid lockdowns, the average proportion of first-time bookers for the arts had dwindled to around 50%, from 55% in 2013.

Post-lockdown, the proportion of first-time bookers peaked at 56% in 2022, and 54% last year - making new audience members more important than ever as a segment of arts audiences.

It's hard to keep first-timers attending regularly in the long term. But audience members who first bought tickets in 2022 are more likely to stay engaged than they were before the pandemic - creating a real opportunity to reverse decline and build a new, loyal, post-lockdown audience base.

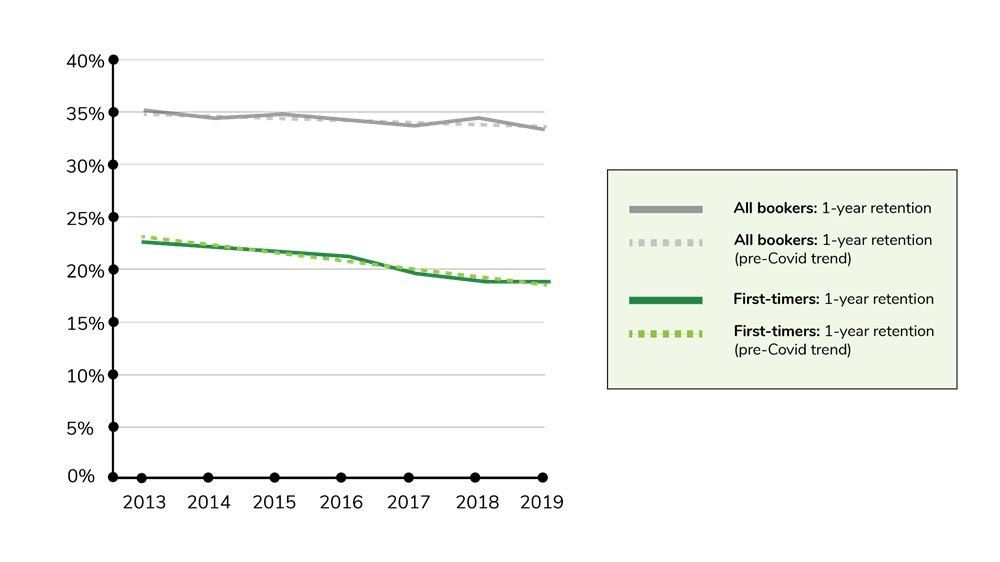

Audience retention, or loyalty, has been in steady decline for at least a decade. By 2019, only around a third of all ticket buyers returned to the same arts organisation each year.

Reattendance by first-time bookers was lower still, and declining faster. Of those customers who first bought a ticket in 2012, 22.5% returned a year later. Six years later, only 18.3% of 2018's new ticket buyers returned in 2019.

In 2019, rapidly declining retention rates for first time bookers appeared to be the most significant driver of overall decline.

Now that it's finally, largely, behind us, we can look back and understand the full impact of the pandemic on arts sector audiences. And more importantly still, we can now look at a full year of post-lockdown data - helping us to focus not on what audiences were doing in the past, but on what they might be doing tomorrow.

Unsurprisingly, reattendance nosedived in 2020-2021. And after a brief, but probably illusory, peak in 2022 - when the small size of the 2021 cohort makes return visitor numbers unreliable - overall audience loyalty is settling back toward pre-Covid trendlines.

The chart below shows the reattendance data for all ticket buyers (in grey) and first-timers (in green). By 'erasing' the outliers of the lockdown years, we can see clearly that, across the UK arts sector, it's the newest bookers who are bucking a decade-long trend.

Of all audience members who first bought tickets in 2022, 19.5% returned in 2023 - a rate of retention unmatched since 2016!

We know first-time bookers are a large cohort - more than half of overall audiences. This data shows that they're also a vital one. The shift in behaviour by first-timers represents a real opportunity for the arts sector not only to recover from the pandemic, but to thrive.

If arts sector leaders can help this trend continue, it could show the way out of a 10+ year decline in reattendance and loyalty.

Stay in touch for future updates from Spektrix

Spektrix works with over 600 arts and entertainment organisations across the US, Canada, UK and Ireland. Our data on first-time audience reattendance includes real sales data from the vast majority of users in the UK, meaning our figures are based on what we believe to be the most comprehensive dataset of its kind in the cultural sector.

Full Description of Our DataData used in our Audience Retention data is intended to allow for analysis of how many ticket buyers were retained by the same arts organisations over two years or more; for example, how many people bought a ticket for a given theatre in 2022, and also in 2023.

We're looking at ticket buyers, rather than attendees. This means that some individuals may not be counted as retained if they purchased a ticket in one year, and someone else purchased on their behalf in another. Some customers may be counted as first-timers if they booked tickets on their own behalf in a given year, having previously had them booked by others.

Data is drawn from 340 arts culture and entertainment organisations in the UK, ranging from small regional theatres to major international arts centres. To ensure that the data is not skewed by outlier periods, organisations are only included if the number of individuals in their cohort and retention year is 1,000 or greater. The average (mean) size of organisation saw around 18,500 unique ticket buyers in 2022.

Calculations are made at organisation level and then aggregated. (e.g. organisation x has a rate of 24.2, organisation y 24.4 - the average is 24.3)

Customers: Individuals who made a transaction of any kind (under their own name/account) in the period specified.

Ticket bookers: Individuals who purchased a ticket (under their own name/account) in the period specified.

First-timers: Individuals who purchased tickets to their first ever attendance (under their own name/account)

The latest analysis of arts audience behaviours - from ticket buying to philanthropy, online activity, and reattendance.

Compare global ticket sales in 2023 to pre-pandemic booking patterns, broken down by country and artform.